In today’s SaaS space, success is driven by data, so the ability to track and analyze the right financial metrics has never been more important for SaaS businesses in 2024.

These metrics are more than just numbers; they’re powerful insights that unveil the true performance, health, and potential of your company.

With the ever-increasing competition and continually evolving market demands, staying ahead of the curve requires a data-driven approach.

By mastering these top 10 SaaS financial metrics, you'll gain a competitive edge, attract investors, and foster long-lasting customer relationships - it’s really a no-brainer.

So, in this essential guide, we'll explore the most crucial SaaS financial metrics that every SaaS professional should have on their radar in 2024 and beyond.

Get ready to unlock the power of data and drive sustainable growth for your SaaS business!

Let’s dive in…

1. Net Revenue Retention Rate (NRR):

Net Revenue Retention Rate (NRR) is a true testament to the health of your customer relationships. It illustrates revenue growth from existing customers, encompassing expansions, churn, and contractions.

An NRR above 100% signifies not only retaining existing revenue but also organic growth through upsells and cross-sells.

In 2024, monitoring NRR is crucial for adapting your strategies, ensuring customer satisfaction, and driving long-term revenue growth.

A high NRR is a clear indicator of your ability to foster lasting relationships and deliver continuous value to your customers.

2. Customer Acquisition Cost (CAC):

In 2024, efficient resource allocation is paramount.

Customer Acquisition Cost (CAC) measures the average expenditure required to acquire a new customer, factoring in marketing campaigns, sales efforts, and onboarding costs.

By understanding CAC, businesses can make informed decisions, ensuring a positive return on investment from customer acquisition efforts.

These days, where customer acquisition costs are on the rise, optimizing CAC is crucial for sustainable growth and long-term profitability.

3. Customer Lifetime Value (CLV):

Customer Lifetime Value (CLV) represents the total revenue a business can expect from a customer over the entire duration of their relationship.

It factors in loyalty, repeat purchases, referrals, and overall engagement, providing a holistic view of a customer's worth.

In the ever-evolving market of 2024, CLV is more than just a number, it's a strategic compass.

By comprehensively understanding CLV, businesses can tailor marketing strategies, enhance customer experiences, and prioritize initiatives that nurture long-term relationships with high-value customers.

4. Annual Recurring Revenue (ARR):

Annual Recurring Revenue (ARR) represents the projected annual income that comes from customers who have subscribed to your services or committed to multi-year contracts.

ARR offers a longer-term view of revenue stability, instrumental in strategic planning and financial forecasting.

Why do we measure it? In 2024, ARR serves as the heartbeat of SaaS businesses.

A significant portion of recurring revenue makes it easier to secure funding from investors, thanks to the stability it represents, which in turn leads to more favorable terms for investments.

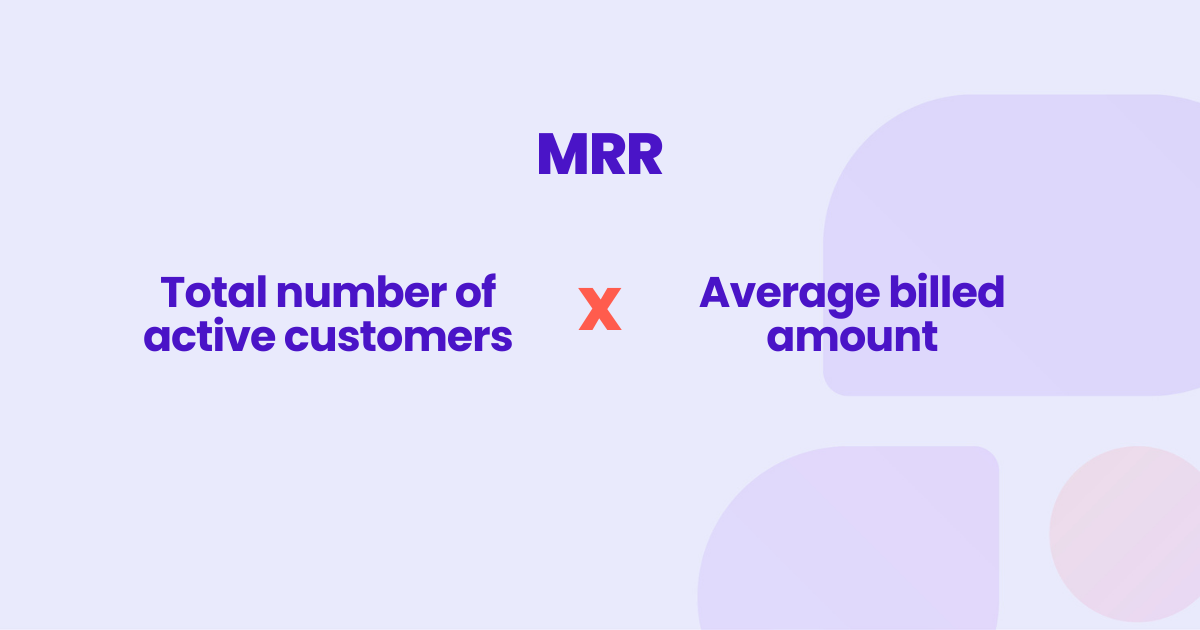

5. Monthly Recurring Revenue (MRR):

Monthly Recurring Revenue (MRR) signifies the aggregate monthly revenue generated from subscription-based customers.

It offers a clear picture of your monthly revenue stability, making it a crucial metric for businesses operating on subscription models.

Why do we measure it? Tracking MRR provides real-time insights into your financial stability and customer trends.

By monitoring MRR, you can make immediate decisions on resource allocation, marketing strategies, and respond promptly to customer behaviors, ensuring sustained profitability in a dynamic market.

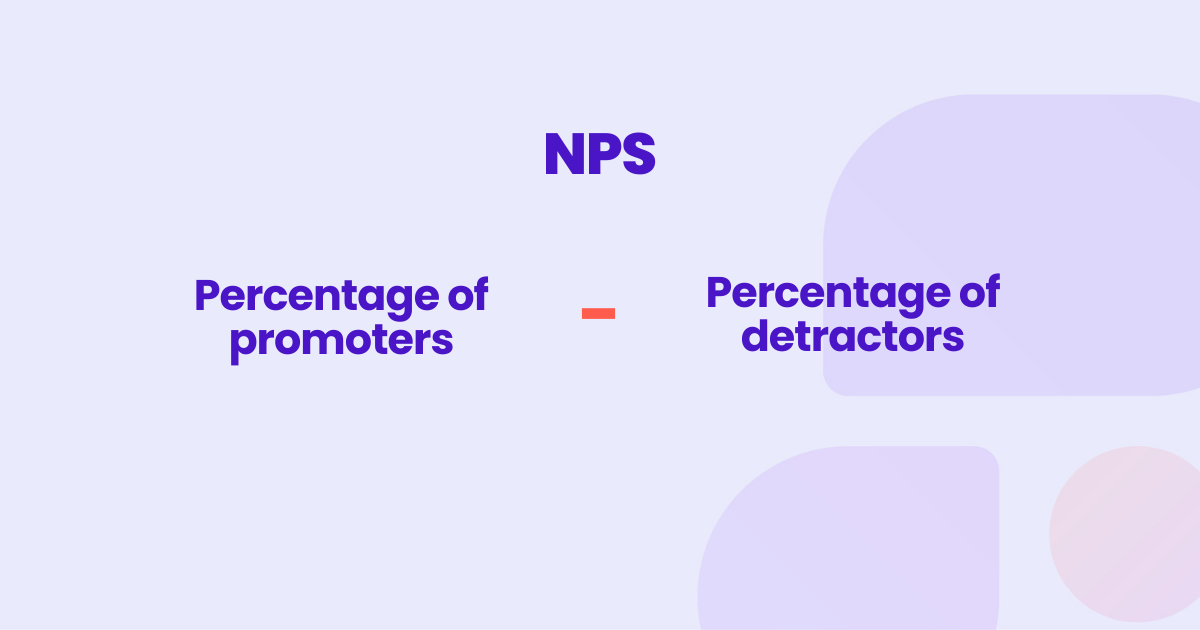

6. Net Promoter Score (NPS):

Net Promoter Score (NPS) is a widely recognized metric for gauging customer loyalty and satisfaction.

By asking customers to rate their likelihood of recommending your product or service on a scale of 0 to 10, you can categorize them as promoters, passives, or detractors.

In 2024, a high NPS indicates strong customer advocacy and positive word-of-mouth, while a low score may signal the need for improvements in customer experience and support.

NPS is a powerful tool for driving customer-centric strategies and fostering lasting relationships.

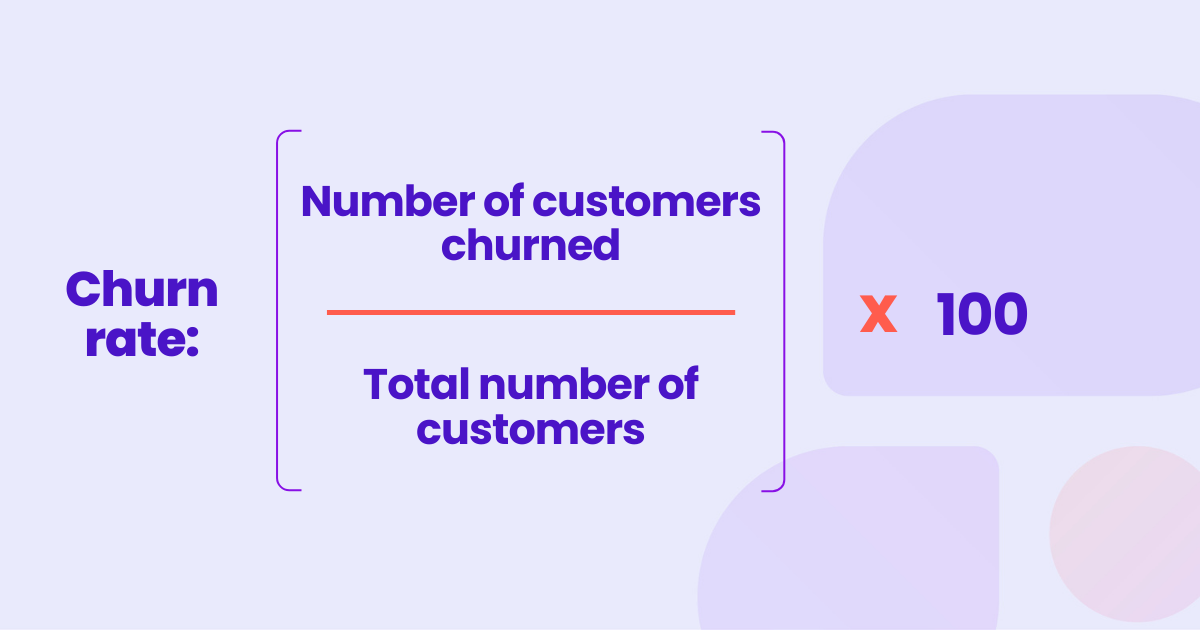

7. Churn Rate:

Churn Rate measures the percentage of existing customers who cancel their subscriptions or discontinue their relationship with your business within a specific time period.

In the current market where competition is tough, customer retention is paramount.

Churn Rate acts as a warning signal, enabling you to address the root causes of customer attrition, enhance customer experiences, and foster long-lasting relationships, ensuring a stable customer base and sustainable revenue.

8. Burn Multiple:

Burn Multiple is a powerful indicator of your company's cash efficiency. It compares the amount of money spent over a period to the net new Annual Recurring Revenue (ARR) generated during that time.

A Burn Multiple under 1 suggests that your existing funds are being utilized efficiently, and growth is sustainable.

However, a high Burn Multiple may indicate the need to reevaluate your spending strategies and secure additional funding sources.

9. Lead Velocity Rate (LVR):

Lead Velocity Rate (LVR) measures the growth rate of qualified leads entering your sales pipeline month over month, providing a leading indicator of future revenue growth.

In 2024, a steady increase in LVR signals a healthy sales pipeline and potential for revenue growth.

Whereas a declining rate may indicate the need to reevaluate lead generation and qualification processes, though it can help you to ensure a consistent flow of high-quality leads.

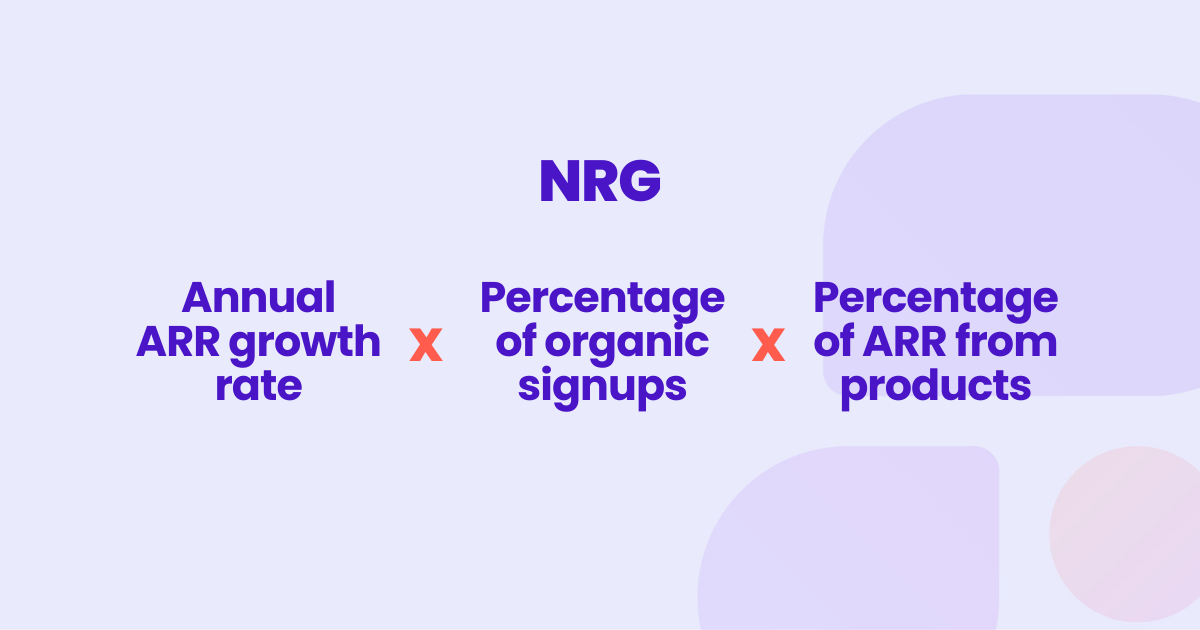

10. Natural Rate of Growth (NRG):

Natural Rate of Growth (NRG) measures your company's organic growth through a product-led approach, without relying heavily on marketing or sales efforts.

A high NRG, typically above 150% for $1-10M ARR companies, indicates a strong focus on delivering customer value through product features.

This then leads to lower customer acquisition costs, higher revenue per employee, and improved customer loyalty.

Conclusion

In 2024, staying ahead of the curve requires a data-driven approach led by these top 10 SaaS financial metrics.

From Net Revenue Retention Rate to Natural Rate of Growth, these powerful indicators provide a comprehensive view of your company's performance, health, and potential.

By mastering these metrics, you'll unlock invaluable insights, enabling you to make informed decisions, optimize operations, foster customer loyalty, and drive sustainable growth.

Embrace the power of data and position your SaaS business for success in 2024 and beyond!