This article is taken from a talk Yael Barak gave at the Future of SaaS festival 2021. Catch the full talk on demand right here.

If you’re starting out in SaaS, you’ve probably wondered how you can bring your payments in-house. How can you cut out those pesky financial middlemen that are eating away at your bottom line?

I’m here to tell you how you can do that and increase customer retention into the bargain by embedding payments directly into your platform.

Here’s a breakdown of our main talking points:

- What is embedded payments?

- How can embedded payments boost your brand?

- The crawl, walk, run of embedded payments

- Embedded payments use cases

- Payments readiness self-assessment

But first, let me tell you a little bit about myself and what I do at Checkout.

About me and Checkout

I'm Yael Barak, VP of Product Management at Checkout.com. We’re a global payment solutions provider that helps businesses and their communities thrive in the digital economy using our own next-generation payments platform.

Or, if you want to get really technical, we're a full-stack, end-to-end proprietary platform for payments and payouts.

Throughout my career, I've worked globally in many markets, across digital and physical commerce platforms.

I’ve been focusing on SaaS for the last 15 years, and 13 of those years have been spent either deploying payment solutions for SaaS platforms or helping SaaS enterprises to find new revenue opportunities.

We’re helping SaaS companies increase their brand value by embedding payment solutions directly into their platforms.

What is embedded payment?

If you've been around SaaS for a while, you know that embedded payments are not a new trend.

Every platform out there, from e-commerce companies to verticalized business management solutions, either already has embedded payment or is thinking about it, and rightfully so.

At some point, revenue opportunity from payments inevitably exceeds the revenue opportunity from platform fees, so it makes sense to bring your payments in-house.

Let’s take a closer look at what embedded payment is, and how it can help boost your brand.

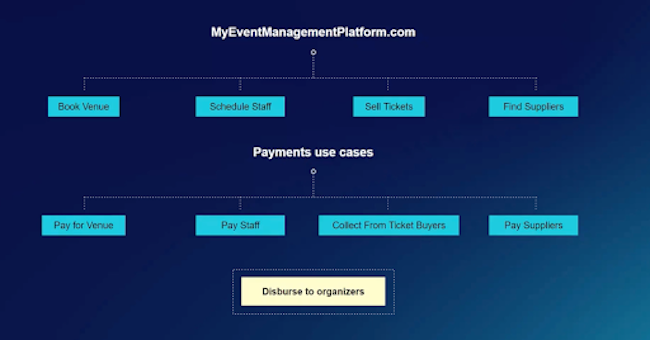

I'm going to take an example of an events management platform. Let’s say you're an event organizer.

You can use this platform to book your venue, schedule staff for your event, sell tickets, and maybe find suppliers, caterers, sound systems, and so on. Those are the core functionalities of your platform that drive payments and payouts.

In a non-embedded payments scenario, your platform might help event organizers book venues, but the whole payment experience would happen outside of the platform.

After the event, the venue would issue an invoice, and the event organizer would pay it.

With embedded payments, all of your payment use cases are on the platform, and the event organizer can connect and transact directly with customers and suppliers. Way simpler, right?

How can embedded payments boost your brand?

So, why embed payments into your platform? Yes, it's definitely a way to optimize revenue, increase the bottom line and open up new revenue opportunities.

But more importantly, it improves the customer experience, creates added value for your platform and enhances brand reputation.

Embedding payment capabilities is not just about having another billable service or another way to collect fees from your clients; it's a way to differentiate your brand and your platform.

When you embed payments, you'll be surrounding your customers with services that go beyond the core capabilities of the SaaS platform and help them manage their business.

As a result, they come to think of you as more involved in their day-to-day operation. They assign more value to your platform and your brand, and they become more ‘sticky’ to you as customers.

The crawl, walk, run of embedded payments

As with any other extension of your platform’s capabilities, it’s wise to develop embedded payments gradually. Unless you’re running an e-commerce platform, dealing with payments is probably not one of your core skills, and it can be overwhelming at first.

To help guide you through how to introduce embedded payments, I want to give you a “crawl, walk, run” type of scenario.

You should take your first steps carefully, then figure things out with a little hand-holding along the way, until you eventually become the expert and are very much in control of every aspect of the payment experience.

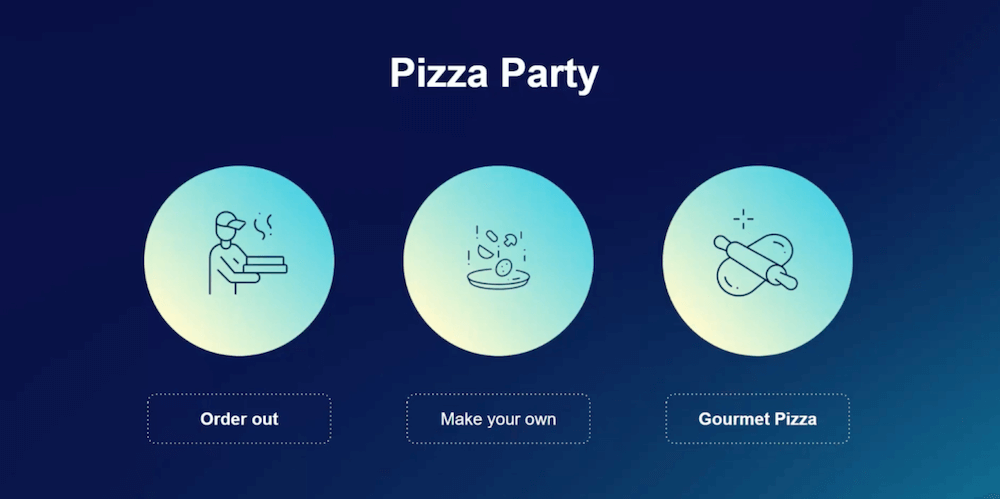

To give a little analogy on what “crawl, walk, run” might mean for payments, let's talk about throwing a pizza party.

You’re throwing your first pizza party for a few friends, and to keep things simple, you decide to call your favorite pizza place and order the usual. Half an hour later the doorbell rings and there are your pizzas. All done – you fed your guests. You got a no-fuss, ready-to-go, out-of-the-box experience.

At your next pizza party, you might be thinking about how one of your friends is vegan and another friend for some reason loves Hawaiian pizza, so this time you want to customize your order.

You call up the pizza place and say, “Hey, give me three regular, one cheese-free, and one Hawaiian for my wild-card friend.” Now you’re accommodating your friends and making sure that everyone gets something they're happy with.

By now, you’re becoming a pro and for your next pizza party you might decide to get all the ingredients and make your own pizza dough and choose the cheese – you’re going gourmet here.

Every person at the party gets to select their toppings and have the pizza they’ve been dreaming of. So essentially, you're going from out of the box to lightly customized to fully gourmet and catering to very specific requirements.

Just like with your pizza party, you want to start simple when you first embed payments into your platform and decide how to build your payments program.

As you get into this, there are three major use cases that you’ll need to consider:

- Onboarding your customers

- Payment methods

- Payouts

Embedded payments use cases

So let’s start with your customers. These are the business owners who are going to be accepting payments or payouts through your platform.

Let’s say you're running the events management platform I mentioned earlier in the article; your customers are either events organizers or the suppliers who list themselves on your marketplace to get booked.

All these clients need to be onboarded, meaning you’ll have to take some details from them before accepting or making payments on their behalf.

Next, you need to make sure that you can accept the payment methods your customers want to use, whether that’s Mastercard, ApplePay, or a good old-fashioned bank transfer.

And when you accept these payments, ideally, you want to be able to control the fees, because ultimately those fees are going to hit your bottom line.

Make sure you keep tabs on how much you’re paying and how much you’re charging for the payment service. And finally, you want to be able to make payouts, so if for example, your customer sold 100 tickets for $1,000, you can get that money (minus any fees) into their bank account.

Payments readiness self-assessment

As I said before, unless you’re running an e-commerce platform, no one expects you to be an expert in processing payments.

If you’re just starting out, there’s a good chance that you don’t yet have staff that can deal with the nitty-gritty of transactions either, so you might not be ready for a fully-customized payments experience yet, but there are other options.

To help you figure out where you are on your journey of readiness to embed payments, let’s look at a few self-assessment points.

Should we be thinking about embedding payments yet?

The first question to ask yourself is: should I even be thinking about embedding payments yet? Take a good look at your core platform and be brutally honest about how strong it is. Why? Because payments are just an extension of your platform, not the main value proposition.

Your main value proposition is events management, wellness, or whatever it is that your customers come to you for. Those are the features and values that you bring to your market, and until you have those totally figured out, expanding into payments is just going to be a distraction.

Go into payments when you've figured out your basic platform, you're in a market, you're scaled and you're trying to optimize. This is about optimizing revenue opportunities and creating more value on top of value that is already there.

Once you’re ready to deal with transactions, it’s time to decide what is the best model of embedded payments for you.

Choosing the right payments model at the right time

Plug and play

Similar to our pizza party, you can outsource your payments program and partner with a company that has an out-of-the-box payments partnership solution. This will allow you to just plug and play.

The downside of the out-of-the-box option is that you’ll usually pay a premium for it. The upside is that you’ll be able to go to market quicker and offload some of the risks of payments to your partner.

It’s a give and take: your payment provider takes on the risk while you still get to provide an in-platform payments solution.

Self-managed partnership

Later, you can graduate into a self-managed partnership model. You're still partnering with a payments provider, but you're taking on more responsibility for managing the operations of the payments program.

It might be that you take over onboarding customers and setting up their payment accounts, or maybe you'll arrange the funding schedule and set the fees.

You and your payments partner are working together to craft a system that works for both sides. You're taking on a little bit more of the risk, but in return, you're getting a better commercial deal and lower fees.

Fully self-managed payments

When you’ve scaled your business and gained some know-how in providing a somewhat customized payments experience for your customers, you’re ready to roll out a fully self-managed embedded payments service.

This is the full-blown “I'm an expert now; I'm ready to optimize” route.

You’ll need to do your homework here. Depending on where you are in the world, there will be different regulatory requirements for taking payments in-house, so research the licenses you need to apply for.

Also, the acquiring banks, credit card companies, and payment providers you deal with will offer you various options for how you can self-manage, so take some time to think these over.

Taking on full responsibility for your payments program means that you have more liability. It’s a good idea to hire people whose dedicated full-time job is dealing with payments and things like merchant fraud, customer inquiries, and chargebacks.

In return for the extra liability, you control every aspect of the experience for your clients. Everything from onboarding, to fees and payment frequency, plus your own margin, is in your hands.

You have full flexibility on every aspect of the merchant experience and therefore you get to optimize something that really works for your platform.

Ultimately, when you embed payments into your platform, the aim is to create a feedback loop.

By offering a new function that improves the features customers are already getting from your platform, you're optimizing the customer experience and increasing your value proposition. The experience feels brand new and creates new revenue streams for your org.

The end result? Your customers start to wonder how they ever got by without you!